What to do? What to do?

Well looks like SCUR was up 0.17 yesterday to close at 6.72. My price target I put on the stock was 7.56. The stock hasn’t been doing a whole lot lately and I was wondering if I should dump it and move on to something else? Are there any opinions out there?

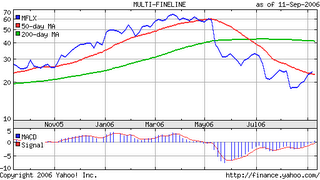

One of the stocks on my list of stocks to watch is MFLX. They have been on a little run as of late and looks like they have just crossed their 50 day moving average and the MACD chart has just hit the positive. The volume on the stock is just a little below the average volume. There is no heavy volume to carry the momentum. Moving into the positive on MACD and crossing the 50day moving average both appear to be good signs. But the markets look to be volatile. What is going on with the broad market?

Well looks like the US trade deficit widened today to record levels which can’t be a good thing. Texas instruments narrowed its earnings forecast for the current quarter last night. On the plus side, Goldman Sachs beat expectations in the third quarter and Apple and Microsoft are both releasing new products today. Oil is lower so that’s a good thing but treasury prices were lower raising yields.

Hmm, what to do. For the time being, I think I’ll wait and see what happens to the SCUR. It had a good day yesterday and I think today will be good too. I realize that the MFLX has broken the 50 day moving average, but I should stick to my plan with SCUR. After all there are plenty of stocks out there and there will always be other opportunity. In my gut the MFLX just doesn’t feel right for now. It feels as if I would be chasing the stock. That’s something I don’t want to get into. If life has taught me anything, it’s to listen to my gut.

One of the stocks on my list of stocks to watch is MFLX. They have been on a little run as of late and looks like they have just crossed their 50 day moving average and the MACD chart has just hit the positive. The volume on the stock is just a little below the average volume. There is no heavy volume to carry the momentum. Moving into the positive on MACD and crossing the 50day moving average both appear to be good signs. But the markets look to be volatile. What is going on with the broad market?

Well looks like the US trade deficit widened today to record levels which can’t be a good thing. Texas instruments narrowed its earnings forecast for the current quarter last night. On the plus side, Goldman Sachs beat expectations in the third quarter and Apple and Microsoft are both releasing new products today. Oil is lower so that’s a good thing but treasury prices were lower raising yields.

Hmm, what to do. For the time being, I think I’ll wait and see what happens to the SCUR. It had a good day yesterday and I think today will be good too. I realize that the MFLX has broken the 50 day moving average, but I should stick to my plan with SCUR. After all there are plenty of stocks out there and there will always be other opportunity. In my gut the MFLX just doesn’t feel right for now. It feels as if I would be chasing the stock. That’s something I don’t want to get into. If life has taught me anything, it’s to listen to my gut.

No comments:

Post a Comment