Quick! Someone Give My Head a Shake.

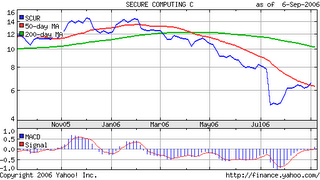

So the Dow finally made it into record territory, but where’s SCUR? Yes there was another downgrade. Now someone needs to give my head a shake. SCUR was over $7.00 then it was downgraded. It fought back to over $7.00 again, but did I sell it? NNNNNNOOOOOOOO!!!!!!!! So then what. There was that nasty old NASDAQ letter that sunk it below $7.00. And today they get another down grade, which drops the price 22 cents to $6.34. So now what?

The approach I’m taking with SCUR is to hang on to it for now. that since the Dow is heading on to new records, I’m going to see if SCUR can battle its way back over $7.00. Then you can believe it that I’m going to sell otherwise my short term play is going to end up being my long term play. Someone give these guys a good contract so I can take my ball and go home.

Back on the oil front, oil rose the last two days on rumors of an OPEC production cut. However, it seems as if only a few countries are in agreement over a production cut. The result is that the price of oil is back down to the $62.00 mark today. Looks like Nigeria will be the lone country to cut production by 5%. But the Alaska pipeline has come back online and inventories are good so it is unlikely that Nigeria’s move will result in any permanent price increase.

Now the only thing the markets have to worry about is the broader economy and the growth rates. From all the indicators in the last month or so it would appear that any inflation worries are dead. That means the only thing the markets can be worried about now is a slow down or a recession. There I said the “R” word, look for the world to fall apart shortly. We’ll just have to see how the senile old farts at the Fed manage this one.

Long term play CLRK is at $17.20.